Are you a spender or a saver? You don’t have to answer that question because there is no correct answer. Let’s face it; there are pros and cons to both sides here. Spenders tend to be incredibly generous people, probably because they aren’t that concerned with holding on to their money. But spenders can also make impulsive decisions and end up with nothing to show for their hard work. Savers, on the other hand, tend to be naturally patient and more responsible, but they can also become stingy and have trouble spending—or giving—a dime. That’s no way to live either! Bottom line: If you are a spender, that’s okay; and if you are a saver, that’s okay.

We put together three ideas that you can implement in your own life to save more money this year, take a look and let us know in the comments below how you intend to save more cash.

Sign up for your company’s pension plan 401k; take your first step today.

Starting down the path to saving for your retirement may be easier than you think: Begin by enrolling in your 401(k), 403(b), or other available workplace savings plan. That's it. You don't have to be a financial guru. It won't take long at all to set up.

But if you have questions, such as how to start saving, help is available. All companies have an administrator for their 401K plan this is a great place to start. You can start with a small contribution and increase your contribution as you grow. Find out the name of the 401K management company they can help you answer other big questions too, like how to create retirement goals, and where to invest your savings.

If your company does not offer a 401k program think about investing into a ROTH IRA which is usually tax deductable.

With a Roth IRA, you make contributions with money on which you've already paid taxes. Your money can then potentially grow tax-free, with tax-free withdrawals in retirement, provided that certain conditions are met.

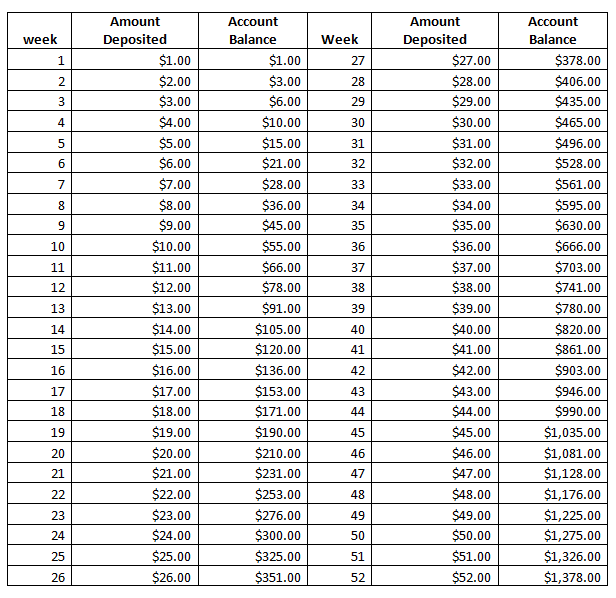

Take the 52 week savings challenge.

The idea is simple. During the first week, you save $1. During the second week, you save $2. Keep adding a dollar each week so that during the last week, you’re socking away $52. Even without interest, this adds up to $1,378 over the course of a year.

Sign up for your company’s pension plan 401k; take your first step today.

Starting down the path to saving for your retirement may be easier than you think: Begin by enrolling in your 401(k), 403(b), or other available workplace savings plan. That's it. You don't have to be a financial guru. It won't take long at all to set up.

But if you have questions, such as how to start saving, help is available. All companies have an administrator for their 401K plan this is a great place to start. You can start with a small contribution and increase your contribution as you grow. Find out the name of the 401K management company they can help you answer other big questions too, like how to create retirement goals, and where to invest your savings.

If your company does not offer a 401k program think about investing into a ROTH IRA which is usually tax deductable.

With a Roth IRA, you make contributions with money on which you've already paid taxes. Your money can then potentially grow tax-free, with tax-free withdrawals in retirement, provided that certain conditions are met.

Take the 52 week savings challenge.

The idea is simple. During the first week, you save $1. During the second week, you save $2. Keep adding a dollar each week so that during the last week, you’re socking away $52. Even without interest, this adds up to $1,378 over the course of a year.